| Part of a series on |

| Climate change and society |

|---|

Climate finance are funding processes for investments related to climate change mitigation and adaptation. The term has been used in a narrower sense to refer to transfers of public resources from developed to developing countries, in light of their UN Climate Convention obligations to provide "new and additional financial resources". In a wider sense, the term refers to all financial flows relating to climate change mitigation and adaptation.[2][3]

The 21st session of the Conference of Parties (COP) to the UNFCCC (Paris 2015) introduced a new era for climate finance, policies, and markets. The Paris Agreement adopted there defined a global action plan to put the world on track to avoid dangerous climate change by limiting global warming to well below 2 °C above preindustrial levels. The agreement covers climate change mitigation, adaptation, and finance. The financing element includes climate-specific support mechanisms and financial aid for mitigation and adaptation activities to spur and enable the transition towards low-carbon, climate-resilient growth and development through capacity building, R&D and economic development.[4]

As of November 2020, development banks and private finance had not reached the US$100 billion per year investment stipulated in the UN climate negotiations for 2020.[5] However, in the face of the COVID-19 pandemic's economic downturn, 450 development banks pledged to fund a "Green recovery" in developing countries.[5]

Definition

Climate finance is "finance that aims at reducing emissions, and enhancing sinks of greenhouse gases and aims at reducing vulnerability of, and maintaining and increasing the resilience of, human and ecological systems to negative climate change impacts", as defined by the United Nations Framework Convention on Climate Change (UNFCCC) Standing Committee on Finance.[6]

The term has also been used in a narrower sense to refer to transfers of public resources from developed to developing countries, in light of their UN Climate Convention obligations to provide "new and additional financial resources". Furthermore, in a wider sense it is used to refer to all financial flows relating to climate change mitigation and adaptation.[2][3]

Types

Multilateral climate finance

Multilateral climate funds

The multilateral climate funds (i.e. governed by multiple national governments) are important for paying out money in climate finance. As of 2022, there are five multilateral climate funds coordinated by the UNFCCC. These are the Green Climate Fund (GCF), the Adaptation Fund (AF), the Least Developed Countries Fund (LDCF), the Special Climate Change Fund (SCCF) and the Global Environment Facility (GEF). The largest of these, the GCF, was formed in 2010.[9][10]

The other main multilateral fund, Climate Investment Funds (CIFs), is coordinated by the World Bank. The Climate Investment Funds has been important in climate finance since 2008.[11][12] It comprises two funds, the Clean Technology Fund and the Strategic Climate Fund. The latter sponsors innovative approaches to existing climate change challenges whereas the former invests in clean technology projects in developing countries.

Also in 2022, nations agreed on a proposal to establish a multilateral loss and damage fund to support communities in averting, minimizing, and addressing damages and risks where adaptation is not enough or comes too late.[13]: 63

Some multi-lateral climate change funds work through grant-only programmes. Other multilateral climate funds use a wider range of financing instruments, including grants, concessional loans, equity, and risk mitigation options.[14]: 2583 These are intended to crowd in other sources of finance, whether from domestic governments, other donors, or the private sector.

Multilateral development banks

Multilateral development banks (MDBs) are important providers of international climate finance. MDBs are financial vehicles created by governments to support economic and social efforts, predominantly in developing countries. The MDBs goals usually mirror the aid and collaboration regulations of their founding members.[15] They complement the programmes of (national government) members' bilateral development agencies, allowing them to work in more countries and at a larger scale.[16] The Paris Agreement also provided momentum for the MDBs to align their investments and strategies with climate goals, and in 2018 the MDBs collectively announced a joint framework for financial flows.[17]: 1553 The MDBs use the widest range of financing instruments including grants, investment loans, equity, guarantees, policy-based financing and results-based financing.[14]: 2583

Finance committed and dispersed

In 2016, the main four funds approved $2.78 billion of project support. India received the largest total amount of single-country support, followed by Ukraine and Chile. Tuvalu received the most funding per person, followed by Samoa and Dominica. The US is the largest donor across the four funds, while Norway makes the largest contribution relative to population size.[18]

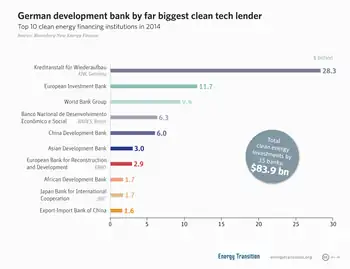

Climate financing by the world's six largest multilateral development banks (MDBs) rose to a seven-year high of $35.2 billion in 2017.

Since 2012, the European Investment Bank has provided €170 billion in climate funding, which has funded over €600 billion in programs to mitigate emissions and help people respond to climate change and biodiversity depletion across Europe and the world.[19][20] In 2022, the Bank's funding for climate change and environmental sustainability projects totaled €36.5 billion. This includes €35 billion for initiatives supporting climate action and €15.9 billion for programs supporting environmental sustainability goals. Projects with combined climate action and environmental sustainability advantages received €14.3 billion in funding.[21]

Over 2021-2030, the EIB Group wants to assist €1 trillion in green investment.[22] Currently, only 5.4% of the Group's loans for climate action are dedicated to climate adaptation, but funding did increase significantly in 2022, reaching €1.9 billion.[23]

In 2009, developed countries committed to jointly mobilize $100 billion annually in climate finance by 2020 to support developing countries in reducing emissions and adapting to climate change.[24] They claim that climate finance provided and mobilized reached $83.3bn in 2020. But the money given for climate change was only worth about a third of what was said ($21–24.5bn).[25]

Bilateral climate finance

Bilateral institutions include development cooperation agencies and national development banks. Until quite recently they have been the largest contributors to climate finance, but since 2020 bilateral flows have decreased whilst multilateral funding has grown.[17]: 1553 Some bilateral donors have thematic or sectoral priorities, whilst many also have geopolitical preferences for working in certain countries or regions.[14]: 2583

Bilateral institutions include donors such as the USAID, the Japan International Cooperation Agency (JICA), Germany's KfW Development Bank and the UK Foreign, Commonwealth and Development Office (FCDO). Many bilateral agencies also make donations through multilateral channels and this allows them to work in more countries and at a larger scale[16]. However the overall international climate finance system (for financial flows from developed to developing countries) is complex and fragmented, with overlapping mandates and objectives. This creates significant co-ordination problems.[26] [27]: 9

Domestic public climate finance

Financial flows and expenditures by national governments on climate are significant. Domestic targets on addressing climate change are set out in national strategies and plans, including those submitted to the UNFCCC under the Paris Agreement. For many developing countries, the plans submitted include targets attached to international financial and technical support (ie. conditional targets).

National-level coordination of climate funding is important for meeting these domestic targets, and in the case of developing countries, also for accessing international funding.[27]: 9 For all countries and regions, it is recognised that public funding will not be sufficient to meet all finance needs. This means that policy makers need to take a strategic approach through using public funding to leverage additional private finance. Other funding can come from financial institutions such as banks, pension funds, insurance companies and asset managers.

Private climate finance

Public finance has traditionally been a significant source of infrastructure investment. However, public budgets are often insufficient for larger and more complex infrastructure projects, particularly in lower-income countries. Climate-compatible investments often have higher investment needs than conventional (fossil fuel) measures,[28] and may also carry higher financial risks because the technologies are not proven or the projects have high upfront costs.[29] If countries are going to access the scale of funding required, it is critical to consider the full spectrum of funding sources and their requirements, as well as the different mechanisms available from them, and how they can be combined.[30] There is therefore growing recognition that private finance will be needed to cover the financing shortfall.

Private investors could be drawn to sustainable urban infrastructure projects where a sufficient return on investment is forecast based on project income flows or low-risk government debt repayments. Bankability and creditworthiness are therefore prerequisites to attracting private finance.[31] Potential sources of climate finance include commercial banks, investment companies, pension funds, insurance companies and sovereign wealth funds. These different investor types will have different risk-return expectations and investment horizons, and projects will need to be structured appropriately.[32]

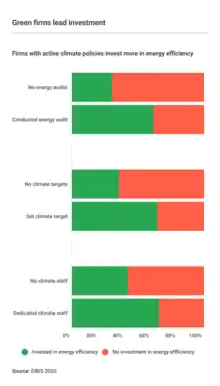

During the COVID-19 pandemic, climate change was addressed by 43% of EU enterprises. Despite the pandemic's effect on businesses, the percentage of firms planning climate-related investment rose to 47%. This was a rise from 2020, when the percentage of climate related investment was at 41%.[33][34] Climate investment in Europe as been growing this decade. However, the need for the EU's "Fit for 55" climate package remains 356 billion euros a year. Since 2020, US firms' desire to innovate has increased, whereas European firms' has decreased.[35] As of 2022, spending in climate for European enterprises has climbed by 10%, reaching 53% on average. This has been especially noticeable in Central and Eastern Europe at 25% and in small and medium-sized firms (SMEs) with a 22% increase in climate financing.[36]

Financial models

Several different financial models or instruments have been used for financing climate actions. The overall business model may include several of these financing mechanisms combined to create the climate solution. Financial models can belong to different categories eg. public budgets, debt, equity, land value capture or revenue generating models etc.

Debt-for-climate swaps

Debt-for-climate swaps happen where debt accumulated by a country is repaid upon fresh discounted terms agreed between the debtor and creditor, where repayment funds in local currency are redirected to domestic projects that boost climate mitigation and adaptation activities.[37] Climate mitigation activities that can benefit from debt-for-climate swaps includes projects that enhance carbon sequestration, renewable energy and conservation of biodiversity as well as oceans.

For instance, Argentina succeed in carrying out such a swap which was implemented by the Environment Minister at the time, Romina Picolotti. The value of debt addressed was $38,100,000 and the environmental swap was $3,100,000 which was redirected to conservation of biodiversity, forests and other climate mitigation activities.[38] Seychelles in collaboration with the Nature Conservancy also undertook a similar debt-for-nature swap where $27 million of debt was redirected to establish marine parks, ocean conservation and ecotourism activities.[39]

Green bonds (or climate bonds)

A Green bond (also known as climate bond) is a fixed-income financial instruments (bond) which is used to fund projects that have positive environmental and/or climate benefits.[40][41] They follow the Green Bond Principles stated by the International Capital Market Association (ICMA),[42] and the proceeds from the issuance of which are to be used for the pre-specified types of projects.

Like normal bonds, climate bonds can be issued by governments, multi-national banks or corporations and the issuing organization repays the bond and any interest. The main difference is that the funds will be used only for positive climate change or environmental projects. This allows investors to target their environmental, social, and corporate governance (ESG) goals by investing in them. They are similar to Sustainability Bonds but sustainability bonds also need to have a positive social outcome.[43]Offsetting (credit trading)

.png.webp)

Revenue-generating models

Revenue generation through for example water-user fees or tariffs can incentivise investment in climate projects.

Revolving Loan Fund

Public–private partnership

Blended finance

Land Value Capture

Quantifying current flows of climate finance

A number of initiatives are underway to monitor and track flows of international climate finance.[65] Analysts at Climate Policy Initiative have tracked public and private sector climate finance flows from a variety of sources on a yearly basis since 2011. In 2019, they estimated that annual climate finance reached more than US$600 billion.[66] This work has fed into the United Nations Framework Convention on Climate Change Biennial Assessment and Overview of Climate Finance Flows [67] and the IPCC Fifth Assessment Report chapter on climate finance. This and other research suggest a need for more efficient monitoring of climate finance flows.[68] In particular, they suggest that funds can do better at synchronizing their reporting of data, being consistent in the way that they report their figures, and providing detailed information on the implementation of projects and programs over time.

Further research finds substantially lower bilateral climate finance numbers than current official estimates.[69][70][71][72] Reasons are among others a lack of universally agreed-upon definitions of what qualifies as international climate finance and no oversight.[73] This has led to an inclusion of non-climate projects, a lack of transparency and ultimately a credibility issue regarding official international climate finance reporting.[73]

The estimates of the climate finance gap - that is, the shortfall in investment - vary according to the geographies, sectors and activities included, timescale and phasing, target and the underlying assumptions.

Aims

Mitigation finance is investment that aims to reduce global carbon emissions. Adaptation finance aims to respond to the consequences of climate change.[17]: 1554

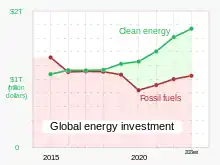

Finance for mitigation

Global climate finance is heavily focused on mitigation. Key sectors for investment have been renewable energy, energy efficiency and transport.[17]: 1549, 1564 There has also been an increase in international climate finance towards the 100 billion target. Most of the estimated US$83.3 billion provided to developing countries in 2020, was targeted at mitigation (US$48.6 billion, or 58%).[74] On a worldwide scale, mitigation financing accounts for over 90% of investment in climate finance. Around 70% of this mitigation money has gone towards renewable energy, however low-carbon mobility is a key development sector.[75] Global energy investment has increased since the 2020 COVID-19 pandemic crisis. However, the crisis has placed a great additional strain on the global economy, debt and the availability of finance, which is expected to be felt in years to come.[17]: 1555

A meta-analysis from 2023 investigated the "required technology-level investment shifts for climate-relevant infrastructure until 2035" within the EU, and found these are "most drastic for power plants, electricity grids and rail infrastructure", ~87€ billion above the planned budgets in the near-term (2021–25), and in need of sustainable finance policies.[76][77]

In 2010, the World Development Report preliminary estimates of financing needs for mitigation and adaptation activities in developing countries range from $140 to 175 billion per year for mitigation over the next 20 years with associated financing needs of $265–565 billion and $30–100 billion a year over the period 2010–2050 for adaptation.[78]

The International Energy Agency's 2011 World Energy Outlook (WEO) estimates that in order to meet the growing demand for energy through 2035, $16.9 trillion in new investment for new power generation is projected, with renewable energy (RE) comprising 60% of the total.[79] The capital required to meet projected energy demand through 2030 amounts to $1.1 trillion per year on average, distributed (almost evenly) between the large emerging economies (China, India, Brazil, etc.) and the remaining developing countries.[80] It is believed that over the next 15 years, the world will require about $90 trillion in new infrastructure – most of it in developing and middle-income countries.[81] The IEA estimates that limiting the rise in global temperature to below 2 Celsius by the end of the century will require an average of $3.5 trillion a year in energy sector investments until 2050.[81]

Finance for adaptation

Finance is an important enabler for climate adaptation, for both developed and developing countries.[14]: 2586 It can come from a variety of sources. Public finance is provided directly by governments or via intermediaries such as development finance institutions (eg. MDBs or other development agencies). It can also be channelled through multilateral climate funds. Some multilateral climate funds have a specific focus on adaptation within their mandate. These include the Green Climate Fund, the CIFs and the Adaptation Fund. Private finance can come from commercial banks, institutional investors, other private equity or other companies or from household or community funding.

Finance can be delivered through a range of instruments including grants or subsidies, concessional and non-concessional (ie. market) loans as well as other debt instruments, equity issuances (listed or unlisted shares) or can be delivered through own funds, such as savings.[14]: 2588

Issues of responsibility and justice in climate finance

Climate finance responsibility

As developed countries are responsible for the majority of cumulative emissions since the industrialization and generally have greater capacity to provide support, it is argued, that they have a moral responsibility and a legal obligation to provide finance to help developing countries undertake climate action.[82] At the 16th Conference of the Parties in 2010 (Cancun 2010) developed countries committed to the goal of mobilizing jointly USD 100 billion per year by 2020 to address the needs of developing countries, and the decision by the 21st Conference of the Parties (Paris 2015) also included the commitment to continue their existing collective mobilization goal through 2025.[82] However, these agreements don't offer guidance on how to allocate climate finance responsibility to individual countries. Several institutions and researchers have developed methodologies to determine country-specific contribution shares based on equity-principles.

Climate finance allocation mechanism

Climate finance allocation mechanisms play a crucial role in determining how funds are distributed to different countries to address the impacts of climate change. These mechanisms aim to distribute funds fairly, taking into account various factors that represent each country's responsibility for and vulnerability to climate change, as well as their capacity to finance mitigation and adaptation measures.

All leading models have in common that they at least use one wealth variable (e.g. share of GDP or GNI) to consider the ability to pay and an emission variable (share of CO2 or GHG) to reflect emission responsibility.[82] Some models additionally consider countries' population or their willingness to pay.[82] Furthermore, another proposal of a mechanism suggests to incorporate forward-looking data in so-called dynamic model. For the dynamic components, the share of GDP is determined by a 2030 forecast adjusted for expected climate damages and the share of GHGs covers future emissions up to 2030 and accounts for unconditional emission reduction targets submitted by the countries where available.[83]

See also

References

- ↑ "World Energy Investment 2023 / Overview and key findings". International Energy Agency (IEA). 25 May 2023. Archived from the original on 31 May 2023.

Global energy investment in clean energy and in fossil fuels, 2015-2023 (chart)

— From pages 8 and 12 of World Energy Investment 2023 (archive). - 1 2 Oscar Reyes (2013), "A Glossary of Climate Finance Terms", Institute for Policy Studies, Washington DC, p. 10 and 11

- 1 2 "Search | Eldis".

- ↑ Barbara Buchner, Angela Falconer, Morgan Hervé-Mignucci, Chiara Trabacchi and Marcel Brinkman (2011) "The Landscape of Climate Finance" A CPI Report, Climate Policy Initiative, Venice (Italy), p. 1 and 2.

- 1 2 "Banks around world in joint pledge on 'green recovery' after Covid". the Guardian. 2020-11-11. Retrieved 2020-11-12.

- ↑ "Documents | UNFCCC". unfccc.int. Retrieved 2018-09-08.

- ↑ "Firms brace for climate change". European Investment Bank. Retrieved 2021-10-12.

- ↑ European Investment Bank (2021-01-21). EIB Investment Report 2020/2021: Building a smart and green Europe in the COVID-19 era. European Investment Bank. doi:10.2867/904099. ISBN 978-92-861-4811-8.

- ↑ "Climate Finance | UNFCCC". unfccc.int. Retrieved 2018-12-03.

- ↑ Global, IndraStra. "Climate Finance: Essential Components, Existing Challenges, and On-going Initiatives". IndraStra Global. ISSN 2381-3652. Retrieved 2022-12-27.

- ↑ "Climate Investment Opportunities in Cities - An IFC Analysis". www.ifc.org. Retrieved 2021-04-15.

- ↑ "10 Years of Climate Action". Climate Investment Funds. 2019-05-31. Retrieved 2021-04-15.

- ↑ United Nations Environment Programme (2023). Adaptation Gap Report 2023: Underfinanced.Underprepared. Inadequate investment and planning on climate adaptation leaves world exposed. Nairobi. https://doi.org/10.59117/20.500.11822/43796

- 1 2 3 4 5 New, M., D. Reckien, D. Viner, C. Adler, S.-M. Cheong, C. Conde, A. Constable, E. Coughlan de Perez, A. Lammel, R. Mechler, B. Orlove, and W. Solecki, 2022: Chapter 17: Decision-Making Options for Managing Risk. In: Climate Change 2022: Impacts, Adaptation and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [H.-O. Pörtner, D.C. Roberts, M. Tignor, E.S. Poloczanska, K. Mintenbeck, A. Alegría, M. Craig, S. Langsdorf, S. Löschke, V. Möller, A. Okem, B. Rama (eds.)]. Cambridge University Press, Cambridge, UK and New York, NY, USA, pp. 2539–2654, doi:10.1017/9781009325844.026.

- ↑ "Multilateral development banks". EIB.org. Retrieved 2023-11-03.

- 1 2 Department for International Development (2011), Multilateral Aid Review: ensuring maximum value for money for UK aid through multilateral organisations

- 1 2 3 4 5 Kreibiehl, S., T. Yong Jung, S. Battiston, P. E. Carvajal, C. Clapp, D. Dasgupta, N. Dube, R. Jachnik, K. Morita, N. Samargandi, M. Williams, 2022: Investment and finance. In IPCC, 2022: Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [P.R. Shukla, J. Skea, R. Slade, A. Al Khourdajie, R. van Diemen, D. McCollum, M. Pathak, S. Some, P. Vyas, R. Fradera, M. Belkacemi, A. Hasija, G. Lisboa, S. Luz, J. Malley, (eds.)]. Cambridge University Press, Cambridge, UK and New York, NY, USA. doi: 10.1017/9781009157926.017

- ↑ "Mapped: Where multilateral climate funds spend their money". Carbon Brief. 2017.

- ↑ "CIS Interview: Vice President Ambroise Fayolle, the European Investment Bank". CIS. 2020-10-27. Retrieved 2021-05-18.

- ↑ "A plan for the long haul to contribute finance to the European Green Deal". European Investment Bank. Retrieved 2021-05-18.

- ↑ Bank, European Investment (2023-02-02). "Climate Action and Environmental Sustainability Overview 2023".

{{cite journal}}: Cite journal requires|journal=(help) - ↑ Bank, European Investment (2023-06-29). EIB Group Sustainability report 2022. European Investment Bank. ISBN 978-92-861-5543-7.

- ↑ "Press corner". European Commission - European Commission. Retrieved 2023-07-14.

- ↑ Bos, Julie; Gonzalez, Lorena; Thwaites, Joe (7 October 2021). "Are Countries Providing Enough to the $100 Billion Climate Finance Goal?". Retrieved 24 October 2022.

- ↑ "climate finance Short Changed" (PDF). OXFAM. Retrieved 24 October 2022.

- ↑ Atteridge, A., Siebert, C. K., Klein, R. J., Butler, C., & Tella, P. (2009). Bilateral finance institutions and climate change: A mapping of climate portfolios. Stockholm Environment Institute (SEI).

- 1 2 Coordination Challenges in Climate Finance. Erik Lundsgaarde, Kendra Dupuy, Åsa Persson, Danish Institute for International Studies. Copenhagen: DIIS. 2018. ISBN 978-87-7605-924-8. OCLC 1099681274.

{{cite book}}: CS1 maint: others (link) - ↑ Gouldson A, Colenbrander S, Sudmant A, McAnulla F, Kerr N, Sakai P, Hall S, Papargyropoulou E, Kuylenstierna J (2015). "Exploring the economic case for climate action in cities". Global Environmental Change. 35: 93–105. doi:10.1016/j.gloenvcha.2015.07.009.

- ↑ Schmidt, TS (2014). "Low-carbon investment risks and de-risking". Nature Climate Change. 4 (4): 237–239. Bibcode:2014NatCC...4..237S. doi:10.1038/nclimate2112.

- ↑ Understanding 'bankability' and unlocking climate finance for climate compatible development, Climate & Development Knowledge Network, 31 July 2017

- ↑ Colenbrander S, Lindfield M, Lufkin J, Quijano N (2018). "Financing Low-Carbon, Climate-Resilient Cities" (PDF). Coalition for Urban Transitions. Archived from the original (PDF) on 2018-04-12. Retrieved 2018-04-11.

- ↑ Floater G, Dowling D, Chan D, Ulterino M, Braunstein J, McMinn T, Ahmad E (2017). "Global Review of Finance for Sustainable Urban Infrastructure". Coalition for Urban Transitions.

- ↑ Bank, European Investment (2022-01-12). EIB Investment Report 2021/2022: Recovery as a springboard for change. European Investment Bank. ISBN 978-92-861-5155-2.

- ↑ "Latest EIB survey: The state of EU business investment 2021". European Investment Bank. Retrieved 2022-01-31.

- ↑ "European investment offensive needed to keep up with US subsidies". European Investment Bank. Retrieved 2023-02-28.

- ↑ Bank, European Investment (2023-04-12). What drives firms’ investment in climate change? Evidence from the 2022-2023 EIB Investment Survey. European Investment Bank. ISBN 978-92-861-5537-6.

- ↑ Picolotti, Romina; Zaelke, Durwood; Silverman-Roati, Korey; Ferris, Richard (2020). "Debt-for-Climate Swaps" (PDF). Institute for Governance and Sustainable Development: 3.

{{cite journal}}: Cite journal requires|journal=(help) - ↑ "Debt-for-Climate Swaps Can Help Developing Countries Make a Green Recovery". Sustainable Recovery 2020. November 13, 2020. Retrieved 2020-12-01.

- ↑ Goering, Laurie (2020-09-07). "Debt swaps could free funds to tame climate, biodiversity and virus threats". Reuters. Retrieved 2020-12-01.

- ↑ "Explaining green bonds". 10 December 2014. Archived from the original on 2020-04-24. Retrieved 2020-04-14.

- ↑ "Climate bonds Standard v2" (PDF). Archived (PDF) from the original on 2019-11-25. Retrieved 2020-04-14.

- ↑ "Green Bond Principles". www.icmagroup.org. Archived from the original on 2020-05-30. Retrieved 2020-05-22.

- ↑ "Green, Social and Sustainability Bonds". Archived from the original on 2020-04-21. Retrieved 2020-04-14.

- ↑ Goodward, Jenna; Kelly, Alexia (August 2010). "Bottom Line on Offsets". World Resources Institute. Archived from the original on 2019-01-17. Retrieved 2010-09-08.

- ↑ "Carbon offset". Collins English Dictionary - Complete & Unabridged 11th Edition. Retrieved September 21, 2012 from CollinsDictionary.com. Archived from the original on October 4, 2018. Retrieved September 24, 2012.

- ↑ "What are Offsets?". Carbon Offset Research & Education. Archived from the original on 2019-11-21. Retrieved 2018-10-23.

- ↑ What is a Voluntary Carbon Market Credit? (PDF) (Report). S&P Global Commodity Insights. 2021. Retrieved May 4, 2023.

- ↑ Fredman, Alex; Phillips, Todd (October 7, 2022). The CFTC Should Raise Standards and Mitigate Fraud in the Carbon Offsets Market (Report). Center for American Progress. Retrieved May 4, 2023.

- ↑ "Emissions Trading – UNFCCC". United Nations. Retrieved May 4, 2023.

- ↑ Tacconi, L (2012). "Redefining payments for environmental services". Ecological Economics. 73 (1): 29–36. doi:10.1016/j.ecolecon.2011.09.028.

- ↑ Clapp, Sarah L. C. (November 1931), "The Beginnings of Subscription Publication in the Seventeenth Century", Modern Philology, Chicago: The University of Chicago Press, 29 (2): 199–224, doi:10.1086/387957, JSTOR 433632, S2CID 162013335

- ↑ Barseghian, Alex. "Council Post: What's Behind The Rise Of The Subscription Model?". Forbes. Archived from the original on 2021-12-28. Retrieved 2021-01-13.

- ↑ "Archived copy". Archived from the original on 2016-03-10. Retrieved 2019-04-15.

{{cite web}}: CS1 maint: archived copy as title (link) - ↑ Hodge, G. A and Greve, C. (2007), Public–Private Partnerships: An International Performance Review, Public Administration Review, 2007, Vol. 67(3), pp. 545–558

- ↑ Roehrich, Jens K.; Lewis, Michael A.; George, Gerard (2014). "Are public–private partnerships a healthy option? A systematic literature review". Social Science & Medicine. 113: 110–119. doi:10.1016/j.socscimed.2014.03.037. PMID 24861412.

- ↑ Caves, R. W. (2004). Encyclopedia of the City. Routledge. pp. 551. ISBN 9780415252256.

- ↑ Bovaird, Tony (2015-09-25). Bovaird, Tony; Loeffler, Elke (eds.). Public Management and Governance. doi:10.4324/9781315693279. ISBN 9781315693279.

- ↑ "Blended Finance | Convergence". www.convergence.finance. Retrieved 2018-09-04.

- ↑ "World Economic Forum - Home". www3.weforum.org.

- ↑ "What kind of blender do we need to finance the SDGs?". UNDP in Europe and Central Asia. Archived from the original on 2021-11-03. Retrieved 2021-11-03.

- ↑ "Developing countries face $2.5 trillion annual investment gap in key sustainable development sectors, UNCTAD report estimates | UNCTAD". unctad.org. 24 June 2014.

- ↑ "Archived copy" (PDF). Archived from the original (PDF) on 2017-05-10. Retrieved 2016-04-29.

{{cite web}}: CS1 maint: archived copy as title (link) - ↑ https://www.un.org/esa/ffd/wp-content/uploads/2015/08/AAAA_Outcome.pdf

- ↑ Gielen, Demetrio Muñoz; van der Krabben, Erwin, eds. (2019-05-01). Public Infrastructure, Private Finance. Abingdon, Oxon ; New York, NY : Routledge, 2019. | Series: Routledge research in planning and urban design: Routledge. doi:10.4324/9781351129169. ISBN 978-1-351-12916-9. S2CID 211775151.

{{cite book}}: CS1 maint: location (link) - ↑ "Global Landscape of Climate Finance, A Decade of Data: 2011-2020" (PDF). CPI. Retrieved 3 November 2022.

- ↑ "Global Landscape of Climate Finance 2019". CPI.

- ↑ "Biennial Assessment and Overview of Climate Finance Flows | UNFCCC". unfccc.int.

- ↑ "Watson, C., Nakhooda, S., Caravani, A. and Schalatek, L. (2012) The practical challenges of monitoring climate finance: Insights from Climate Funds Update. Overseas Development Institute Briefing Paper" (PDF).

- ↑ Toetzke, Malte; Stünzi, Anna; Egli, Florian (October 2022). "Consistent and replicable estimation of bilateral climate finance". Nature Climate Change. 12 (10): 897–900. doi:10.1038/s41558-022-01482-7.

- ↑ Donner, Simon D; Kandlikar, Milind; Webber, Sophie (2016-05-01). "Measuring and tracking the flow of climate change adaptation aid to the developing world". Environmental Research Letters. 11 (5): 054006. doi:10.1088/1748-9326/11/5/054006. ISSN 1748-9326.

- ↑ Michaelowa, Axel; Michaelowa, Katharina (2011-11-01). "Coding Error or Statistical Embellishment? The Political Economy of Reporting Climate Aid". World Development. Expanding Our Understanding of Aid with a New Generation in Development Finance Information. 39 (11): 2010–2020. doi:10.1016/j.worlddev.2011.07.020. ISSN 0305-750X.

- ↑ unfccc.int (PDF) https://unfccc.int/sites/default/files/resource/Assessing%20the%20credibility.pdf. Retrieved 2023-11-03.

{{cite web}}: Missing or empty|title=(help) - 1 2 "A pledge to fight climate change is sending money to strange places". Reuters. 2023-06-01. Retrieved 2023-11-03.

- ↑ OECD (2022), Aggregate trends of Climate Finance Provided and Mobilised by Developed Countries in 2013-2020, https://www.oecd.org/climate-change/finance-usd-100-billion-goal.

- ↑ Bank, European Investment (2023-09-27). Finance in Africa: Uncertain times, resilient banks: African finance at a crossroads. European Investment Bank. ISBN 978-92-861-5598-7.

- ↑ "Studie sieht EU-weit 87 Milliarden Euro Mehrbedarf bei Erneuerbaren und E-Verkehr | MDR.DE". www.mdr.de (in German). Archived from the original on 17 February 2023. Retrieved 17 February 2023.

- ↑ Klaaßen, Lena; Steffen, Bjarne (January 2023). "Meta-analysis on necessary investment shifts to reach net zero pathways in Europe". Nature Climate Change. 13 (1): 58–66. Bibcode:2023NatCC..13...58K. doi:10.1038/s41558-022-01549-5. ISSN 1758-6798. S2CID 255624692.

- Expert reviews of the study: "Notwendige Investitionen auf dem Weg zu Netto-Null-Emissionen". www.sciencemediacenter.de. Archived from the original on 17 February 2023. Retrieved 17 February 2023.

- ↑ World Bank Group(2010), "World Development Report 2010: Development and Climate Change, World Bank Groupe, Washington DC, ch. 6, p. 257

- ↑ International Energy Agency (2011). World Energy Outlook 2011, OECD and IEA, Paris (France), Part B, ch.2

- ↑ International Energy Agency (2011). World Energy Outlook 2011}, OECD and IEA, Paris (France), Part B, ch.2

- 1 2 "Climate Finance". World Bank. Retrieved 2018-09-08.

- 1 2 3 4 Thwaites, Joe; Bos, Julie (2021). "A Breakdown of Developed Countries' Public Climate Finance Contributions Towards the $100 Billion Goal". World Resources Institute: 58. doi:10.46830/writn.20.00145.

- ↑ Egli, Florian; Stünzi, Anna (2019-11-01). "A dynamic climate finance allocation mechanism reflecting the Paris Agreement". Environmental Research Letters. 14 (11): 114024. doi:10.1088/1748-9326/ab443b. ISSN 1748-9326.

External links

- Climate Finance Landscape - Global Landscape of Climate Finance 2019