| European Union regulation | |

| Text with EEA relevance | |

| |

| Title | Proposal for a regulation of the European Parliament and the Council establishing a carbon border adjustment mechanism |

|---|---|

| Made under | Article 192(1) of the TFEU |

| History | |

| European Parliament vote | 18 April 2023 |

| Council Vote | 25 April 2023 |

| Preparative texts | |

| Commission proposal | COM/2021/564 final |

| Current legislation | |

The Carbon Border Adjustment Mechanism (CBAM) is a carbon tariff on carbon intensive products, such as cement and some electricity,[1] imported by the European Union.[2] Legislated[3] as part of the European Green Deal, it takes effect in 2026, with reporting starting in 2023.[4][5] CBAM was passed by the European Parliament with 450 votes for, 115 against, and 55 abstentions[6][7] and entered into force on 17 May 2023.[8]

Contents

_-_Zhuizi_Mt_IMG_6565.jpg.webp)

The price of CBAM certificates is linked to price of EU allowances under the European Union Emissions Trading System introduced in 2005.[9][10] The CBAM is designed to stem carbon leakage to countries without a carbon price.[11]

After the political (provisional) agreement between the Council and the European Parliament reached in December 2022, the CBAM is expected to enter into force on October 1, 2023; it will apply to products in six carbon intensive sectors highly exposed to international trade: aluminium, cement, iron and steel, electricity, hydrogen and fertilisers. During the transitional phase, the regulators will be checking if other products can be added to the list like for example some downstream products.[8]

To address the ‘lose-lose’ scenario of carbon leakage,[12] characterised by a general loss of competitiveness of EU industries with no gain from the perspective of climate protection, the CBAM will require importers of the targeted goods to purchase a sufficient amount of ‘CBAM certificates’ to cover the emissions embedded in their products. Since the main purpose of the CBAM is to avoid carbon leakage, the mechanism tries to subject covered imports to the same carbon price imposed on internal producers under the EU ETS. In other words, the EU is trying to make importers bear an equivalent burden, for what concerns regulatory costs, to the costs of European producers.

Under article 6, importers must make a "CBAM declaration" with the quantity of goods, embedded emissions, and certificates for payment of the carbon import tax.

Annex I sets out the goods that attract the import tax, including cement, electricity, fertilisers (such as nitric acid, ammonia, potassium), iron and steel (including tanks, drums, containers), and aluminium.

Annex II specifies that the CBAM does not apply to four non-EU member states that are included in the European Economic Area, namely Iceland, Liechtenstein, Norway and Switzerland.

Annex III sets out the methods for calculating embedded greenhouse gas emissions.

Exporters will be required to report their emissions and purchase CBAM certificates, which will increase their costs and reduce their profitability.

Debate

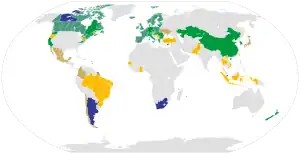

The implementation of the Carbon Border Adjustment Mechanism (CBAM) by the European Union (EU) is a major step towards addressing the issue of carbon leakage and ensuring a level playing field for European businesses worldwide against cheaper goods without carbon taxation. The import partners most affected will be Russia, China, Turkey, Ukraine, the Balkans, as well as Mozambique, Zimbabwe, and Cameroon.[13] This mechanism allows the EU to unilaterally impose a levy on imports from countries that do not meet the environmental standards set by the European Union.

Compliance and monitoring

However, enforcing the CBAM requires a robust compliance framework that would ensure transparency, accuracy, and effectiveness, as argued by two law professors. Firstly, the EU should establish clear and objective environmental standards that businesses must meet to avoid tariffs. These standards should be based on internationally recognized methodologies and benchmarks. Moreover, they should be regularly reviewed and updated to reflect the latest scientific and technological advances in the field of climate change mitigation. By setting clear and objective standards, the EU can ensure that businesses clearly understand what they need to do to comply with the CBAM.

Secondly, the EU should require businesses to submit detailed data on their carbon emissions and energy consumption. This data should be verified by an independent third party to ensure its accuracy and reliability. Businesses that fail to provide accurate data should be subject to penalties and fines. The EU should also establish a reporting framework that would enable businesses to report their carbon emissions and energy consumption in a standardized and consistent manner. This framework should be compatible with existing international reporting standards.

Thirdly, the EU should establish a robust verification and enforcement mechanism to ensure compliance with the CBAM. This mechanism should include regular audits of businesses' emission data, as well as on-site inspections of their production facilities. Non-compliant businesses should be subject to sanctions, such as fines, product seizures, or the exclusion from the EU market. Additionally, the EU should establish a complaint mechanism that would allow stakeholders, such as NGOs or competitors, to raise concerns about non-compliance with the CBAM.[14]

WTO compatibility and non-discrimination

The EU should ensure that the CBAM is compatible with its international obligations under the World Trade Organization (WTO), according to two legal scholars at the University of Ottawa.[15] This means that the mechanism should not discriminate against any particular country or violate the principles of free trade. The EU should also engage in constructive dialogue with its trading partners, including major emitters such as China and the United States, to ensure that the CBAM is consistent with global climate goals and does not create unnecessary tensions or trade disputes.[16]

Incentivisation of carbon pricing in countries outside the EU

If countries outside the European Union have or will create their own carbon pricing policies, "they will avoid the EU’s carbon border tax and keep the revenues for their own decarbonization projects".[17]

The carbon import tax is not yet proposed to apply to a wide range of other products or services, such as automobiles, clothing, food and animal products (such as ones that lead to deforestation), shipping, aviation, or the importation of gas, oil and coal.

There are suggestions, that the mechanism will help reduce emissions not only by making companies reduce emissions but also by incentivising other countries (like the United States, which lacks federal carbon pricing)[18] to create similar mechanisms.[19]

As of November 2023, the Indian Commerce and Industry Ministry under Piyush Goyal is considering levying its own carbon tax to keep the revenues for their own budget.[20]

Developing countries

According to one Amsterdam legal scholar, the EU should provide adequate support to the least developed countries (LDCs) to help them comply with the CBAM. This support could include technical assistance, capacity building, or financial incentives for investments in low-carbon technologies. By providing such support, the EU can ensure that businesses have the necessary resources and knowledge to transition to a low-carbon economy and avoid the risk of carbon leakage.[21] Another author has suggested that the transition to a low-carbon economy requires technology and investment, which may require investment in countries in the Global South. Proposed solutions include technology transfer and green finance.[22]

References

- ↑ Gore, Tim (13 September 2021). "The proposal for a Carbon Border Adjustment Mechanism fails the ambition and equity tests". Heinrich-Böll-Stiftung. Retrieved 3 October 2021.

- ↑ "Ministry urges firms to step up decarbonization". Taipei Times. 2 October 2021. Retrieved 3 October 2021.

- ↑ Smith-Meyer, Bjarke (14 September 2021). "OECD boss: Digital tax deal can inspire global deal on carbon pricing". Politico. Retrieved 3 October 2021.

- ↑ "The EU Carbon Border Adjustment Mechanism : inspiration for others or Pandora's box?". www.engage.hoganlovells.com. Archived from the original on 28 September 2021. Retrieved 22 November 2021.

- ↑ Hancock, Alice; Espinoza, Javier (18 December 2022). "Brussels agrees details of world-first carbon border tax". Financial Times. Retrieved 20 December 2022.

- ↑ "Carbon border adjustment mechanism as part of the European green deal". Legislative Train Schedule (European Parliament). 20 November 2022. Retrieved 20 December 2022.

- ↑ "Results of Votes (22 June 2022)" (PDF). European Parliament. 22 June 2022. Archived from the original (PDF) on 9 July 2022. Retrieved 20 December 2022.

- 1 2 "Carbon Border Adjustment Mechanism". European Commission. European Union. Retrieved 21 May 2023.

- ↑ "A European Union Carbon Border Adjustment Mechanism: Implications for developing countries" (PDF). UNCTAD. Archived (PDF) from the original on 14 July 2021.

- ↑ "The Carbon Border Adjustment Mechanism (CBAM)". www.ey.com. 20 July 2021. Archived from the original on 28 January 2022. Retrieved 3 October 2021.

- ↑ "Carbon Border Adjustment Mechanism (CBAM) will stem 'carbon leakage', European Commission tax and customs chief tells MEPs". The Parliament Magazine. 13 September 2021. Retrieved 3 October 2021.

- ↑ "Publication: Report of the High-Level Commission on Carbon Pricing and Competitiveness © World Bank, Washington, DC". openknowledge.worldbank.org. 2019.

- ↑ Magacho, Guilherme; Espagne, Etienne; Godin, Antoine (13 April 2023). "Impacts of the CBAM on EU trade partners: consequences for developing countries". Climate Policy: 1–17. doi:10.1080/14693062.2023.2200758. ISSN 1469-3062. S2CID 258138399.

- ↑ Perez, Oren, and Michael P. Vandenbergh. "Making Climate Pledges Stick: A Private Ordering Mechanism for Climate Commitments." Available at SSRN 4346020 (2023).

- ↑ Dufour, Geneviève & Thool, Valériane, "Le projet de mécanisme d'ajustement carbone aux frontières: passe-t-il le test du droit de l'OMC?" (2023), dans L’Union européenne, puissance globale dans les relations internationales et transatlantiques, Bruylant, 513-542.

- ↑ Bellora, Cecilia, and Lionel Fontagné. "EU in search of a WTO-compatible carbon border adjustment mechanism."

- ↑ Todorović, Igor. "As CBAM carbon border tax looms, EU wants to help Western Balkans to adapt". Balkan Green Energy News. Retrieved 24 May 2023.

- ↑ "Why the US should establish a carbon price either through reconciliation or other legislation". Brookings. Retrieved 12 November 2023.

- ↑ Copley, Michael (17 May 2023). "How a European law might get companies around the world to cut climate pollution". NPR. Retrieved 21 May 2023.

- ↑ Dhoot, Vikas (2 November 2023). "CBAM will kill EU manufacturing, India will have its own carbon taxes: Goyal". The Hindu. ISSN 0971-751X. Retrieved 29 November 2023.

- ↑ Venzke, Ingo, and Geraldo Vidigal. "Are Trade Measures to Tackle the Climate Crisis the End of Differentiated Responsibilities? The Case of the EU Carbon Border Adjustment Mechanism (CBAM)." Amsterdam Law School Legal Studies Research Paper 2022-02 (2022).

- ↑ Eicke, Laima; Weko, Silvia; Apergi, Maria; Marian, Adela (October 2021). "Pulling up the carbon ladder? Decarbonization, dependence, and third-country risks from the European carbon border adjustment mechanism". Energy Research & Social Science. 80: 102240. doi:10.1016/j.erss.2021.102240. S2CID 239666843.